18 Foods That Could Disappear Before Summer Because Of Supply Issues

Empty shelves aren’t just a bad memory—they could be coming back sooner than you think. Global conflicts, extreme weather, and fragile logistics are squeezing supplies of everyday staples.

From breakfast essentials to cookout must-haves, several favorites could be scarce before summer hits. Read on to see which foods are at risk and how to prepare without panic.

1. Olive Oil

Olive oil prices have surged as drought and heatwaves ravage Mediterranean groves, slashing olive yields across Spain, Italy, and Greece. Producers are bottling less, while global demand remains steady, tightening inventories week by week.

Smaller harvests mean premium extra-virgin varieties are especially vulnerable to stockouts in spring. Restaurants that depend on consistent flavor profiles are already rationing.

Home cooks may notice fewer sizes on shelves and more blends replacing pure origin oils. If conditions don’t improve, substitutions like high-oleic sunflower or avocado oil will grow in popularity. Expect promotions to shrink and store-brand inventory to sell out first.

2. Rice

Rice supplies face pressure due to export restrictions from key producers and weather disruptions in South and Southeast Asia. India’s curbs on non-basmati shipments and uneven monsoon rains have tightened global trade flows.

Import-dependent countries are drawing down reserves, leaving supermarkets with limited varieties and sizes. Parboiled and jasmine are particularly volatile, with prices creeping up weekly.

Foodservice buyers are pivoting to mixed-origin blends to stretch budgets. Retailers may prioritize smaller bags to spread supply across more households.

If El Niño lingers, yields could suffer further. Consider stocking shelf-stable alternatives like couscous or bulgur for short-term flexibility.

3. Coffee

Coffee markets are jittery as erratic rainfall and higher temperatures hit Brazil and Vietnam, the world’s largest producers. Lower arabica and robusta yields, combined with shipping bottlenecks, are compressing inventories.

Specialty roasters report delays in green bean arrivals and higher contract prices. Consumers may see more blends and less single-origin stock through spring.

Café menus could shift roast profiles to maintain consistency. Instant coffee lines are generally more insulated but not immune.

If port congestion persists, replenishment cycles will lengthen, making sellouts more common. Consider buying your preferred roast sooner and storing beans airtight in a cool, dark place.

4. Cocoa and Chocolate

Cocoa futures have soared as West African crops face disease pressures, aging trees, and unseasonal weather. Ghana and Ivory Coast, which supply most global cocoa, are reporting lower-than-expected output.

Chocolate manufacturers are reformulating, shrinking bar sizes, or raising prices to cope. Seasonal confectionery lines may be limited, with premium dark varieties hardest hit.

Bakeries depending on couverture could face delays. Shoppers might see more alternatives using carob or reduced cocoa percentages.

Supply chain analysts warn that new plantings take years to mature, prolonging tightness. If you love a specific brand, buy early—spring promos are likely to be thinner than usual.

5. Canned Tuna

Pacific fishing disruptions, stricter quotas, and higher fuel costs are squeezing canned tuna supply. Skipjack and albacore stocks are tightly managed, and weather patterns have pushed schools farther from traditional grounds.

Processors in Southeast Asia report intermittent plant slowdowns due to raw fish shortages. Retailers could prioritize multipacks over single cans to stabilize demand.

Expect more store brands and fewer promotional discounts through early summer. Sustainability certifications may remain, but fewer SKU choices could appear.

If shipments slip, salads and lunch staples will feel the pinch. Consider diversifying with sardines or mackerel, which often maintain better availability under similar pressures.

6. Orange Juice

Florida’s groves continue to struggle with citrus greening disease, while Brazil faces weather volatility and logistics issues. The result: concentrated orange juice supplies remain historically tight.

Brands are blending origins and reducing promotional activity to stretch inventory. Consumers may notice smaller cartons and higher prices in the chilled section.

Some labels are shifting to “citrus blends” to stabilize flavor and volume. Foodservice dispensers in hotels and cafés could limit refills during peak breakfast hours.

If frosts hit late-season fruit, the squeeze intensifies. For breakfast flexibility, consider switching to apple or grape juice until summer crops recover.

7. Avocados

Avocado availability is vulnerable as Mexico and parts of California navigate drought, inspections, and security concerns. Seasonal gaps between harvests can magnify shortfalls when shipments stall.

Retailers are already trimming promotions that typically spike before summer gatherings. Foodservice buyers may downsize portions or pivot to alternative toppings.

Ripeness programs can’t fix missing volume, so expect more hard fruit or uneven quality. If cross-border disruptions flare, prices jump quickly.

Guacamole lovers should watch for smaller bag sizes and fewer multi-buy deals. Consider lima beans or peas for dip bases as a temporary stand-in when avocados run thin.

8. Lettuce

Lettuce fields in California and Arizona have battled disease outbreaks and weather swings, leading to inconsistent yields. Romaine and iceberg, staples for salads and fast-casual menus, are especially vulnerable.

Processors report trimming shredded lines to prioritize whole heads. Consumers may notice more brown edges or shorter freshness windows.

Restaurants could switch to mixed greens or cabbage blends to keep costs in check. Spring heat spikes risk bolting, further shrinking supply.

If you rely on bagged salads, expect rotating out-of-stocks during weekly resets. Buying whole heads and washing at home can help stretch quality amid tight harvest windows.

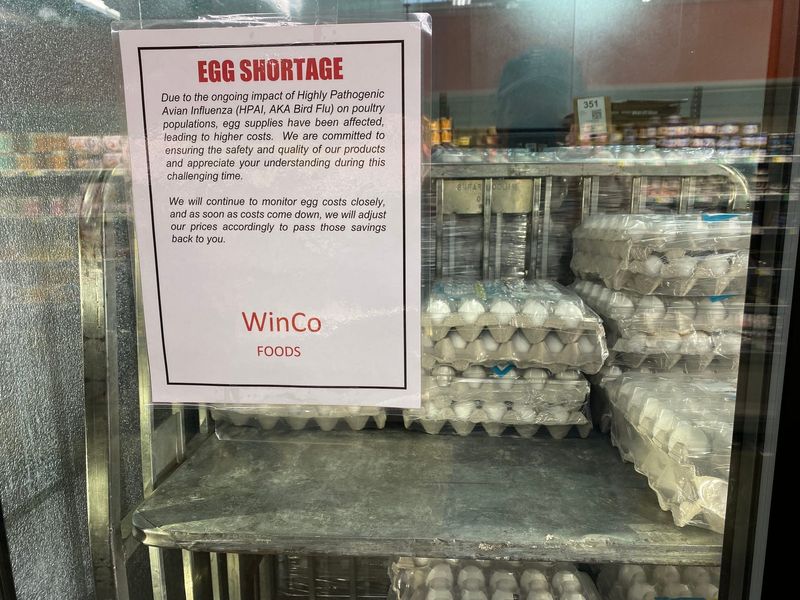

9. Eggs

Egg supplies remain vulnerable as avian influenza continues to affect laying flocks across multiple regions. Biosecurity measures slow recovery, and restocking barns takes months.

Wholesale prices can spike overnight when outbreaks occur, rippling into retail aisles quickly. Bakeries and restaurants may reformulate recipes or limit breakfast offerings during tight weeks.

Consumers could see carton limits return briefly if local supply dips. Cage-free lines, with smaller producer bases, often feel the strain first.

Consider frozen or shelf-stable egg alternatives for backup. If outbreaks subside, supplies normalize, but volatility is likely through late spring as farms rebuild capacity.

10. Beef

Beef is tightening as North American cattle herds remain at multi-decade lows following drought and high feed costs. Feedlots are marketing fewer animals, and processors are running leaner schedules.

Retailers may downplay steak promotions heading into grilling season. Ground beef is prioritized, but prices could drift higher.

Restaurants are introducing smaller cuts and more chicken-focused specials. Import volumes help, yet shipping delays and currency swings complicate planning.

If pasture conditions don’t improve this spring, herd rebuilding will lag. Consider mixing plant-based proteins into meals to stretch recipes without sacrificing satisfaction during spot shortages.

11. Chicken Wings

Wing demand spikes during sports playoffs and summer cookouts, but processors are still balancing bird sizes and labor constraints. When birds trend larger, yields shift toward boneless cuts, reducing wing availability.

Cold storage inventories are uneven regionally, causing sudden retail gaps. Restaurants may raise combo prices or limit sauce options to simplify procurement. Expect fewer buy-one-get-one deals at supermarkets through May.

Boneless wings, often made from breast meat, could stay plentiful, but purists will notice the difference. Planning ahead for parties and exploring drumsticks as an alternative can help bridge shortfalls without killing the vibe.

12. Maple Syrup

Warm winters and erratic freeze-thaw cycles jeopardize maple sap flows in the Northeast and Canada. Producers need sustained temperature swings to collect sap efficiently.

Shorter seasons and lower sugar content mean fewer barrels and higher per-unit costs. Artisanal brands feel the pinch first due to limited storage.

Grocery shelves may show more blended syrups or smaller bottle formats to stretch supply. Pancake houses could swap to alternative sweeteners during peak brunch hours.

If temperatures normalize, yields may stabilize, but forecasts remain shaky. Consider buying a bottle early and storing in a cool, dark place to avoid springtime markups.

13. Canned Tomatoes

California’s tomato processors are recovering from water constraints and past heat waves that reduced yields. While acreage has improved, inventories remain tight and contract-heavy, leaving retail shelves vulnerable to gaps.

Pasta sauces and crushed tomatoes see the most pressure. Restaurants reliant on consistent acidity may switch brands mid-season. Expect fewer price promotions as manufacturers rebuild stocks.

Private-label lines often adjust first, shrinking variety. If spring storms disrupt planting, late-summer availability worsens. Consider keeping an extra can or two and exploring roasted red peppers or passata as flexible substitutes for sauces and stews.

14. Sugar

Global sugar supplies are strained by weather impacts in Brazil, India, and Thailand, key producers for raw and refined sugar. Export quotas and strong ethanol demand tighten availability for food makers.

Bakers and beverage brands are paying more, sometimes reformulating to alternative sweeteners. Retailers may cap big promotional displays for granulated sugar as summer canning season approaches.

Brown and powdered sugar could rotate in and out of stock fastest. If harvests rebound, relief arrives late, not in spring. For now, keep reasonable pantry levels and consider honey or maple syrup for recipes where flavor compatibility works.

15. Canned Coconut Milk

Weather disruptions and shipping delays in Southeast Asia are affecting coconut harvests and processing schedules. Many brands rely on a handful of canneries, creating bottlenecks when equipment or labor issues arise.

Restaurant supply chains feel shortages first, especially for curries and desserts. Retailers may ration shelf space to top sellers, sidelining niche organic or flavored options.

Expect occasional dents in consistency, with cream separation more common as inventory ages. If freight costs spike, multipacks could vanish temporarily. Keep a couple of cans on hand and consider powdered coconut milk as a reliable stand-in for recipes.

16. Wheat Flour

Wheat markets remain tight as conflict and export restrictions affect Black Sea shipments, while drought lingers in parts of North America. Mills are prioritizing commercial contracts, leaving retail shelves exposed to sporadic gaps.

Specialty flours like bread and pastry grades can be the first to thin out. Bakeries might adjust hydration and blends to maintain crumb and volume.

Home bakers could see fewer large bag promotions this spring. If planting conditions improve, relief comes after harvest, not before summer. Consider diversifying with spelt or rye flour for flexibility, and store flour airtight to extend freshness.

17. Sunflower Oil

Sunflower oil supplies remain volatile due to ongoing disruptions in Eastern Europe, a major growing and processing region. Crushing facilities face logistical hurdles, and export corridors can clog unexpectedly.

Food manufacturers substitute with rapeseed or soybean oil, pushing cross-market price spikes. Retail bottles may disappear first in budget sizes, with bulk foodservice packs rationed.

Fry-heavy restaurants will adjust fryer blends to maintain performance. If export routes stabilize, inventories could normalize later in the year. For home cooking, buy modestly and consider neutral alternatives like canola while supply chains recalibrate.

18. Blueberries

Blueberry availability hinges on tight harvest windows in the Southern Hemisphere and early domestic crops. Weather swings—late frosts or heavy rains—can erase weeks of output.

Import logistics add risk, with airfreight costs pressuring margins for fresh berries. Retailers may pivot to frozen packs, which are more resilient.

Fresh clamshell sizes could shrink to maintain price points. Foodservice menus will lean on compotes and syrups when fresh fruit is scarce.

If spring warmth arrives abruptly, quality may suffer from softness. Stock frozen berries for smoothies and baking to bridge the gap until peak summer harvests arrive.